Why Wise?

Sending money internationally has traditionally been expensive, slow, and full of hidden fees. Wise (formerly TransferWise) was built to solve that problem. With real exchange rates, transparent fees, and fast transfers, Wise has become one of the most trusted platforms for global money movement.

✨ Key Benefits of Using Wise

- Real Exchange Rate (Mid‑Market Rate): No hidden markups — Wise uses the actual rate you see on Google or XE.

- Low, Transparent Fees: Fees are shown upfront before you confirm a transfer.

- Fast Delivery: Many transfers arrive within minutes or hours.

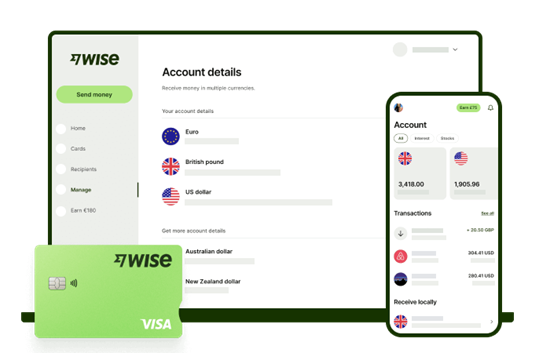

- Multi‑Currency Account: Hold and manage 40+ currencies in one account.

- Trusted Worldwide: Used by over 16 million people and regulated globally.

💸 How the Referral Bonus Works

I’m sharing my Wise referral link: Sign up here for your first fee‑free transfer up to $600.

- You’ll get your first transfer fee‑free (up to $600).

- I’ll receive a small reward for referring you.

- It’s a win‑win — you save money, and it helps me keep creating practical guides through noelCore.

🛠️ Step‑by‑Step: How to Send Money with Wise

- Create a free account using the referral link.

- Enter the amount and recipient’s details.

- Review fees and the exact amount your recipient will get.

- Pay using your bank account, debit card, or other method.

- Track your transfer in real time until it arrives.

📊 Example: Sending $500 from the U.S. to Europe

- Bank transfer: Often $30–$50 in fees + hidden exchange markup.

- Wise: Around $5–$7 in fees, with the real exchange rate.

- Result: Your recipient gets more money, faster.

❓ Frequently Asked Questions About Wise

Is Wise safe to use?

Yes. Wise is regulated by financial authorities in the U.S., UK, EU, and other countries. It uses industry‑standard encryption and two‑factor authentication to protect your account and transfers.

How does Wise offer low fees?

Wise uses a transparent pricing model and avoids hidden exchange rate markups. You pay a small upfront fee, and your money is converted using the real mid‑market rate.

How fast are Wise transfers?

Most transfers arrive within hours, and some are instant depending on the currency and payment method. You’ll see an estimated delivery time before confirming.

What currencies does Wise support?

Wise supports over 40 currencies and lets you hold, convert, and send money between them using one account.

What is the Wise referral program?

When you sign up using a referral link, you get a fee‑free transfer up to $600, and the person who referred you receives a reward. It’s a mutual benefit, not a commercial affiliate commission.

✅ Final Thoughts

Wise is one of the most cost‑effective, transparent, and user‑friendly ways to send money abroad. Whether you’re paying freelancers, supporting family overseas, or managing international business, Wise helps you keep more of your money where it belongs — in your pocket.