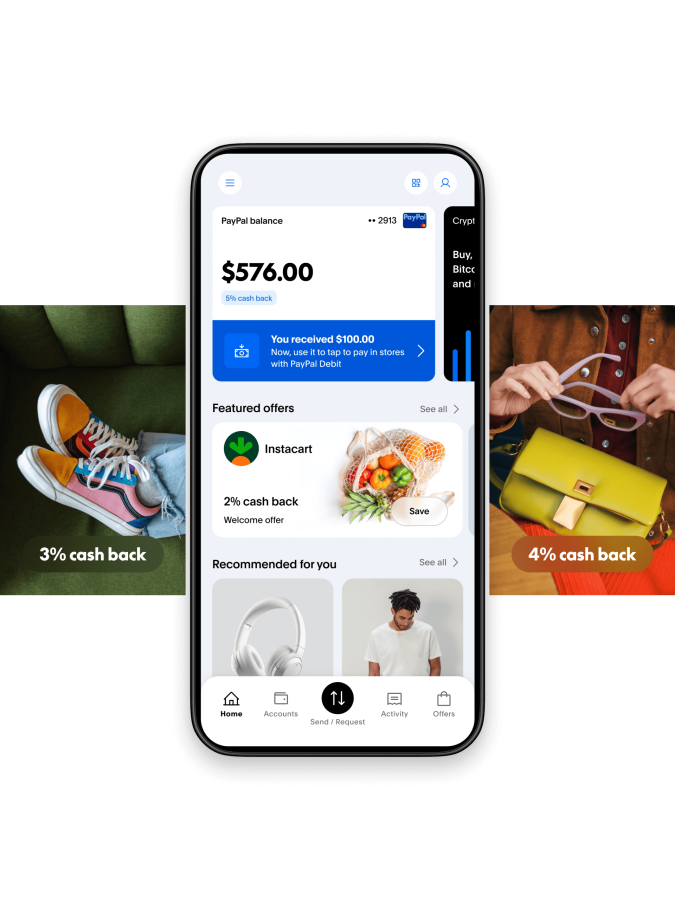

A clear, practical guide to using PayPal for everyday payments, small business, and side projects—what matters, what to watch, and how to set up quickly.

Open PayPal via noelCore’s referral

What PayPal is and why people use it

PayPal is a widely used digital payments platform that helps you send, receive, and manage money online for personal use, freelancing, and small business—without sharing your card details directly with every site you purchase from. Its appeal comes from broad merchant acceptance, buyer protections, and simple peer-to-peer transfers in many regions.

Quick benefits: Broad acceptance for online shopping, streamlined checkout, the ability to pay or get paid without exposing card numbers, and options to hold a balance or withdraw to your bank.

Invite flow: PayPal supports friend referral and invite landing pages to help new users start quickly, including a simple “Welcome to PayPal” on invite links like ours.

Core features that matter day-to-day

- Send money: Pay friends, family, or service providers with an email address or mobile number; add a note and track activity.

- Receive payments: Accept payments for freelance work, marketplace sales, or small business orders without sharing bank details.

- Checkout on websites: Use PayPal at many online stores for faster, card-free checkout and consolidated receipts.

- Balance and withdrawals: Keep funds in your PayPal balance or transfer to your bank; set preferred funding sources.

- Buyer and seller protections: Dispute resolution for unauthorized transactions or item-not-received scenarios (terms vary by region and transaction type).

Tip: For small businesses, enabling PayPal alongside cards can boost checkout completion rates—customers trust familiar, fast payment flows.

Understanding fees in plain language

- Personal transfers: Funding with your bank balance often has no fee domestically; funding with a card typically includes a fee. Cross-border transfers may add currency conversion costs.

- Business payments: Merchant transactions usually include a percentage plus a fixed fee per transaction; rates vary by country, product, and volume.

- Chargebacks and disputes: Sellers may incur fees or losses if claims are resolved against them; keep proof of shipment and communication.

- Withdrawals: Standard bank withdrawals are usually free; instant withdrawals may have a small fee depending on region and method.

Always confirm the latest fees and terms in your local PayPal account, as details change and vary by region.

Setup: from zero to ready in minutes

- Open the referral link: Visit this invite page to start the streamlined “Welcome to PayPal” flow.

- Create your account: Provide your legal name, email, and a strong password. Verify your email immediately.

- Secure it: Turn on two-factor authentication (2FA), and add recovery options you control.

- Add funding sources: Link your bank and card. Set your preferred default for personal vs. business transactions.

- Complete identity checks: If prompted, finish KYC verification for higher limits and smoother withdrawals.

- Test a small transfer: Send a nominal amount to a trusted contact or your second account to confirm everything works.

Security and best practices

- Use strong 2FA: Prefer an authenticator app over SMS when possible.

- Lock down email: Your email is the key; secure it with a unique password and 2FA.

- Review funding defaults: Prevent surprises by checking which source is used for each transaction.

- Watch for phishing: Verify sender addresses, avoid clicking suspicious links, and access PayPal directly.

- Keep records: Save invoices, tracking numbers, and correspondence for smooth dispute handling.

Common scenarios and smart tips

Selling online: Use PayPal invoices to itemize goods, taxes, and shipping. Provide tracking for physical items—this supports seller protection eligibility.

Freelancing: Request payment via invoice or payment link. Clarify scope and delivery in writing to reduce disputes.

Splitting costs: Send money with a clear note (e.g., “October utilities”) and keep the confirmation email as your receipt.

Refunds: Issue refunds through the original transaction so PayPal can track it cleanly for both parties.

FAQ: quick answers

- Is PayPal free to open? Yes. Creating an account is free; some transactions have fees depending on funding source, type, and region.

- Do I need a business account? Use personal for casual transfers and purchases; switch or add business when you’re selling regularly and need invoicing and reporting.

- How fast are withdrawals? Standard bank transfers are typically 1–3 business days; instant options are faster but may have a fee.

- Can I use PayPal without sharing my card? Yes. You can pay with your balance or bank, and merchants receive confirmation—your card number isn’t shared with each store.

- What protections exist? Buyer and seller protections vary by transaction type and compliance with terms; keep documentation and ship with tracking.

Get started via noelCore’s referral

If PayPal fits your workflow, you can open an account using our invite link for a straightforward guided flow:

Start with PayPal through noelCore’s referral